Futures Fall As Google, AMD Tumble; Dollar Slide Continues

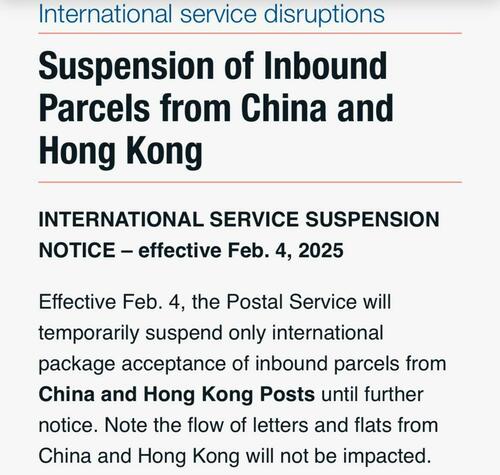

US equity futures slumped, dragged by tech following disappointing earnings from two tech giants (AMD, GOOG) and concerns that an escalation of the Trade War 2.0 will lead to negative revenue impacts for MegaCap Tech (AAPL, Mag7). Further, USPS suspends mail deliveries from China/HK as small parcels that were previously exempt from tariffs are coming under the new Executive Order; impacts about 4mm parcels per day (AMZN; Shein; Temu). As of 8:00am ET, S&P futures were down 0.4%, suggesting Wall Street’s rebound may be short-lived, while Nasdaq 100 futures dropped 0.8% as Google parent Alphabet and AMD plunged in US pre-market trading after disappointing results, and dragged the entire Mag7 lower (GOOGL -7%, AMZN -1%, AAPL -2%, MSFT -0.3%, META -0.4%, NVDA +0.4% and TSLA -1%). Bond yields slide again, dropping 6bps to 4.46%, and down some 14bps from Tuesday's highs as rates react to the negative growth impact rather than the expected inflationary impact. The USD is weaker again and commodities mixed as goal soars to a new record high approaching $2900 while energy is sold, and Ags particularly Softs move higher. Today’s macro data focus is on ADP, Mtge Apps, and ISM-Srvcs though the Trade Balance details may pique the Market’s interest. US companies reporting results on Wednesday include Uber, Disney, Ford and Qualcomm.

In premarket trading, Alphabet plunged 7% after slower growth in its cloud business contributed to lower-than-expected revenue in the fourth quarter. Advanced Micro Devices tumbled 9% after giving a disappointing outlook for its data center business, an area where it’s struggling to catch up with AI computing leader Nvidia Corp. Apple dropped in premarket trading after China’s antitrust watchdog signaled a probe into the company’s policies. The poor tech results and news hit the broader Mag7 group (GOOGL -7%, AMZN -1%, AAPL -2%, MSFT -0.3%, META -0.4%, NVDA +0.4% and TSLA -1%). Here are the other notable premarket movers:

- Broadcom (AVGO) gains 3% after a higher-than-expected capital spending forecast from customer Alphabet, which accounts for 9% of the firm’s sales, according to Bloomberg supply chain data

- Chipotle Mexican Grill (CMG) drops 4% after sales rose less than expected, highlighting the high bar the company set by defying an industrywide traffic slowdown in recent years

- Cirrus Logic (CRUS) rises 8% after the company forecast a 4Q revenue range with a midpoint above what analysts expected

- Electronic Arts (EA) gains 2% after the video-game maker reported third-quarter earnings and provided further context on the underperformance of EA Sports FC

- FMC (FMC) slumps 22% after the agricultural sciences company’s 2025 outlook fell short of expectations

- Harley-Davidson (HOG) slips 2% after 4Q revenue disappointed

- Johnson Controls (JCI) rises 8% after boosting its adjusted earnings per share forecast for the full year

- Lumen Technologies (LUMN) rises 10% after the telecommunications firm reported 4Q profit and revenue that beat estimates

- Match Group (MTCH) falls 8% after the dating service provider forecast revenue for the first quarter below the average analyst estimate and announced a change in CEO

- Mattel (MAT) surges 14% after the toymaker reported better-than-expected 4Q results and FY25 EPS guidance above analyst estimates

- Mercury Systems (MRCY) jumps 19% after the company reported adjusted earnings per share for the second quarter that beat expectations among analysts, who on average expected a loss

- Mondelez (MDLZ) drops 4% after the Oreo cookies-maker issued annual forecasts for organic revenue growth and profit that trailed Wall Street expectations

- Oscar Health Inc. (OSCR) sinks 11% after the insurance firm provided a disappointing 2025 revenue forecast and posted a wider-than-expected loss in the 4Q

- PDD Holdings (PDD) ADRs drop 6% after the US Postal Service said it’s temporarily suspending inbound parcels from China and Hong Kong, sparking concerns that e-commerce shipments from retailers like Shein or PDD’s Temu will be affected

- Among other Chinese e-commerce companies: Alibaba (BABA) -2%, JD.com (JD) -2%

- Uber Technologies (UBER) drops 7% after reporting weaker-than-expected fourth-quarter earnings and operating income, overshadowing steady bookings growth

- Walt Disney Co. (DIS) rises about 1% after reporting fiscal first-quarter results that topped analysts’ estimates, fueled by the blockbuster film Moana 2 and higher income from its streaming services

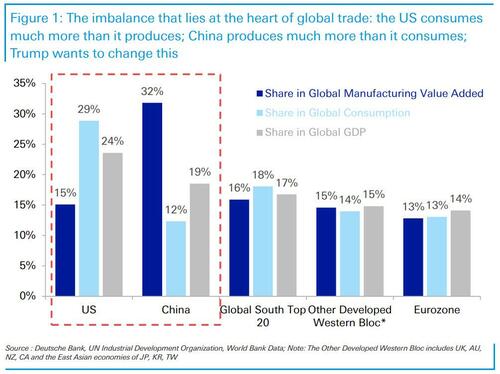

While the first volleys in the latest US-China trade war made clear that Xi Jinping would take a more cautious approach than during Donald Trump’s first term, tariff risks remain at the forefront.

“It remains tough for anyone to have a particularly high degree of conviction when operating in such an uncertain environment,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “I still favor adopting a more cautious stance in the short run, as uncertainty remains elevated, and participants chew through this week’s remaining risk events, including earnings from Amazon, and Friday’s US jobs report.”

Meanwhile, disappointing results from Alphabet and AMD also heightened unease about the outlook for megacap tech companies that have driven the S&P 500’s gains. Alphabet posted fourth-quarter revenue that missed analysts’ expectations after growth in its cloud business slowed, raising concern from investors about the billions the company is spending on artificial intelligence. Chip maker AMD gave a disappointing outlook for its data center business, an area where it’s struggling to catch up with AI computing leader Nvidia Corp. Amazon.com is scheduled to report on Thursday.

“Those expectations that analysts have placed, the bar is a lot higher this time,” said Aneeka Gupta, director of macro-economic research at Wisdomtree UK Ltd. “There is a greater probability that they don’t meet that higher bar. If they disappoint, the ramifications are a lot bigger.”

The breakneck speed of news continue: besides Trump's trade war, companies reporting results on Wednesday include Uber, Disney, Ford Motor and Qualcomm. Traders will also look to the US ISM services data later today for more clues on the Federal Reserve’s rate path. Activity in the services sector likely grew more slowly in January amid winter storms across much of the country and wildfires on the West Coast. High-frequency payroll data suggest hiring activity was relatively steady on a seasonally adjusted basis, according to Bloomberg Economics.

The Stoxx Europe 600 fluctuated, down 0.1% at last check, with declines for technology shares offsetting gains in health care after upbeat guidance from the region’s biggest listed company, Novo Nordisk A/S. Among individual movers in Europe, Spanish lender Banco Santander SA surged after reporting record profit and announcing at €10 billion buyback. Drugmaker GSK Plc. jumped after boosting its sales forecast. Renault SA declined after a report that Nissan Motor, in which it has a 36% stake, will withdraw from its deal with Honda Motor Co. Ltd. to integrate their businesses. Here are the biggest movers Wednesday:

- Novo Nordisk shares rise as much as 6.3% after the Danish drugmaker reported better-than-expected sales for the fourth quarter and provided guidance for 2025 which was also ahead of market expectations

- Santander shares advanced as much as 8.7% to the highest since February 2018 after the Spanish lender reported record earnings and offered a strong outlook for this year

- TotalEnergies shares gain as much as 1.9% to highest since Nov. 19 after France-based energy company reported fourth-quarter net income that beat the average analyst estimate and as it maintains the pace of share buybacks

- Vestas fluctuated between gains and losses in early trading as investors weighed the wind-turbine maker’s guidance, seen as conservative, against a welcome €100m stock buyback and reinstated dividends

- Credit Agricole shares advanced as much as 2.2% to the highest since June after the French lender reported net income for the fourth quarter that beat estimates driven by strength in asset management and insurance

- Bechtle shares rise as much as 6.9% to trade at the highest since mid-November, as preliminary results from the German retailer of computers and office supplies showed a beat on profits

- GSK shares rise as much as 6.7%, the most in almost four months, after the pharmaceutical giant’s results and outlook came in above consensus expectations, while its 2031 sales target was also raised

- LVMH drops as much as 1.2% after the shares are downgraded to hold from buy at Stifel. Its analysts say there is little upside for the luxury goods stock following a recent rally and lack of earnings upgrades

- Husqvarna shares drop as much as 7.3% and are headed for their lowest close since 2020 after the Swedish lawn-care and outdoor-equipment manufacturer’s fourth-quarter results

- Pandora shares fall as much as 4.1% after the Danish jewelry maker’s organic revenue growth forecast for 2025 fell short of estimates. The softer outlook could trigger earnings revisions, RBC says

Earlier in the session, Asian equities advanced as tech shares tracked their US peers higher, offsetting Chinese stock declines due to heightened trade tensions after the onshore market reopened post-holiday. The MSCI Asia Pacific Index rose as much as 1% before trimming gains, with tech-heavy markets such as Taiwan and South Korea helping to lead gains in the region. Japanese stocks reversed midday losses, as Toyota Motor gained after raising its annual operating profit outlook. Honda Motor surged and Nissan Motor slumped after the Nikkei reported that the two competitors failed to reach a consensus on a combination. Onshore Chinese equities traded lower after the Lunar New Year holidays, as sentiment was hit by fresh headlines on Sino-US relations, including a report that the US Postal Service is temporarily suspending inbound parcels from China and Hong Kong. A gauge of Chinese shares listed in Hong Kong fell more than 1%.

In FX, the Bloomberg Dollar Spot Index drops 0.3% to its lowest since Jan. 27, extending yesterday's losses after US job openings fell in December by more than forecast to a three-month low. The move reflects unwinds of longs built on tariff risks and meets spillover of yen strength. USD/JPY drops 1.1% to 152.65, its lowest since Dec. 13; one-week risk reversals are little changed at 140bps, puts over calls. Japan nominal wages rose 4.8% in December from a year earlier, the largest jump since 1997; real wages also grew for a second straight month in December, even as economists expected a drop amid accelerating inflation. The yen also rallied after Economic Revitalization Minister Ryosei Akazawa said the nation is in an inflationary situation.

In rates, treasuries hold gains, accumulated during London morning amid a bigger rally in gilts after a sale of UK 30-year bonds was most oversubscribed since July, leaving yields richer by 2bp-4bp across maturities. Also supporting Treasuries, US equity index futures fell after disappointing earnings from Alphabet and AMD. US 10-year yields trade around 4.45%, richer by 6bps on the day with gilts outperforming by 2.5bp in the sector; long-end leads gains in Treasuries, flattening 2s10s spread by ~1.5bp. Gilts lead a rally in European bonds, with UK 10-year yields falling 7 bps to 4.46%. Bunds extended declines after the ECB’s main gauge of future euro-zone pay growth continued to signal a sharp slowdown in 2025.

In commodities, WTI crude drops to $72 a barrel. Bitcoin rises 1.5% toward $98,000.

Treasuries rise, with US 10-year yields falling ~4 bps to 4.47%. Other haven assets are also bid with gold rising $29 to a fresh record high while the Japanese yen tops the G-10 FX leader board, climbing 1.1% against the greenback. The yen is also bid after data showed Japanese nominal wages rising at the fastest pace in nearly three decades. The Bloomberg Dollar Spot Index falls 0.3%.

Wednesday's US economic data calendar includes January ADP employment change (8:15am), December trade balance (8:30am), January final S&P Global US services PMI (9:45am) and January ISM services index (10am). Fed speaker slate includes Barkin (7:30am and 9am), Goolsbee (2:30pm), Bowman (3pm) and Jefferson (7:30pm)

Market Snapshot

- S&P 500 futures down 0.6% to 6,027.25

- STOXX Europe 600 little changed at 535.55

- MXAP up 0.8% to 184.02

- MXAPJ up 0.4% to 576.88

- Nikkei little changed at 38,831.48

- Topix up 0.3% to 2,745.41

- Hang Seng Index down 0.9% to 20,597.09

- Shanghai Composite down 0.6% to 3,229.49

- Sensex down 0.4% to 78,287.81

- Australia S&P/ASX 200 up 0.5% to 8,416.87

- Kospi up 1.1% to 2,509.27

- German 10Y yield little changed at 2.36%

- Euro up 0.3% to $1.0409

- Brent Futures down 0.9% to $75.53/bbl

- Gold spot up 1.0% to $2,870.42

- US Dollar Index down 0.35% to 107.58

Top Overnight News

- Trump’s plans for the US to take over Gaza have been met with anger and dismay across the Arab world, raising fears of reignited conflict in the region. Saudi Arabia and Turkey on Wednesday dismissed a proposal by President Trump for the US to take control of Gaza and for Palestinians to permanently leave the strip, an idea likely to be also rejected by other Middle Eastern nations. FT, WSJ

- US President Trump mulls revoking loans from the $400bln clean energy office: BBG

- US government officials have privately warned that Elon Musk’s blitz appears illegal. It was separately reported that the US Treasury gave Elon Musk's DOGE 'read-only' access to the payment system: WaPo

- US Senate confirmed US President Trump's nominee Pam Bondi as Attorney General.

- Morgan Stanley expects the Fed to deliver only one 25bps cut this year, in June (prior forecast was for two 25bps cuts)

- Fed's Jefferson (voter) said there is no need to hurry further rate cuts and a strong economy makes caution appropriate, while he added that interest rates are likely to fall over the medium term and disinflation is expected to continue, though progress may be slow. Furthermore, he said the Fed faces uncertainty around government policy and that growth and labour market conditions are expected to remain solid.

- China’s Caixin services PMI for Jan came in at 51, down from 52.2 in Dec and below the Street’s 52.4 forecast. WSJ

- Japan's December inflation-adjusted real wages rose 0.6% year-on-year thanks to a wintertime bonus bump, preliminary government data showed on Wednesday, with government officials expressing optimism that wage hike momentum ahead is growing. RTRS

- French PM Francois Bayrou is set to ride out two no-confidence votes today, giving him the stability needed to implement a delayed 2025 budget. BBG

- The ECB’s wage tracker predicts salaries rising by an annual 1.5% in the fourth quarter, a sharp slowdown from the 5.3% peak recorded a year earlier. While the ECB needs salary growth to slow, it doesn’t want too steep a deceleration. BBG

- Bond traders exited wagers in futures and cash Treasuries in the past week, amid tariff uncertainties. Swaps rates are pricing in just 3 bps of easing next month, or a bit more than a 10% chance of a cut. BBG

- Apple -2.6% in premkt. China’s antitrust watchdog is laying the groundwork for a potential probe into Apple Inc.’s policies and the fees it charges app developers, part of a broader push by Beijing that risks becoming another flashpoint in the country’s trade war with the US. BBG

- INTC (Intel) could be targeted with an antitrust probe in China as Beijing considers further ways to retaliate against Trump’s trade war. FT

- President Donald Trump and officials close to him recently expressed interest in pulling U.S. troops out of Syria, leading Pentagon officials to begin drawing up plans for a full withdrawal in 30, 60 or 90 days. NBC

Earnings Summary

- Advanced Micro Devices (AMD) -8.5% pre-market: Beat on Q4, strong AI-driven growth. Missed data centre sales forecasts.

- Alphabet (GOOGL) -7.3% pre-market: Q4 missed, Cloud growth slowed, foresees 2025 capex above-exp. Making the Gemini 2.0 flash AI model available from Wednesday. Continues its strong relationship with NVIDIA (NVDA).

- Amgen (AMGN) -1.4% pre-market: Q4 beats, Phase 3 trials for obesity drug MariTide will start before mid-year.

- Snap (SNAP) +3.7% pre-market: Strong Q4 numbers, execs. hint at price hikes ahead.

- Credit Agricole (ACA FP) +1.1%: Q4 beat. Loan loss provisions above exp.

- Equinor (EQNR NO) -2.4%: Q4 miss. USD 5bln buyback. 2025 Oil & Production to grow +4% Y/Y.

- GSK (GSK LN) +5.2%: Q4 mixed, FY beat. Announced buyback.

- Novo Nordisk (NOVOB DC) +3.5%: Q4 beat, slight Wegovy miss. Diabetes value market share U/C, diabetes care sales +20%.

- Pandora (PNDRA DC) -1.3%: Q4 mixed/in-line, new buyback, China performance remained challenging at end-Q4.

- TotalEnergies (TTE FP) +1.4%: Q4 beat, raises dividend.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with the region only partially sustaining the positive momentum from the US, as Chinese markets reopened from the Spring Festival and participants digested disappointing China Caixin Services PMI data. ASX 200 edged higher with the gains led by outperformance in the resources, tech and mining sectors, while Australian Services and Composite PMI figures were revised higher from the preliminary release. Nikkei 225 swung between gains and losses with the index pressured intraday as the Japanese currency strengthened after data showed the fastest pace of wage growth in Japan since 1997. Hang Seng and Shanghai Comp declined on the mainland's return from the Spring Festival holiday as participants digested the recent US-China tit-for-tat tariffs, while disappointing Chinese Caixin Services PMI data added to the downbeat mood.

Top Asian News

- Temu and Shien targeted in new EU measures against "dangerous and cheap" e-commerce imports into Europe.

- China's Foreign Ministry, on US President Trump saying he is in no hurry to speak with Xi, says what is needed it dialogue and consultation not unilateral action.

- US President Trump's administration weighs adding Shein and Temu to its forced labour list, according to Semafor.

- BoJ director general of monetary affairs Masaki said the BoJ sees underlying inflation gradually heading toward 2% and price rises post-pandemic have been driven mostly by cost-push factors, such as rising import costs from a weak yen. Masaki stated the BoJ will keep raising interest rates if underlying inflation accelerates towards the 2% target as projected but added the BoJ must support economic activity with accommodative monetary conditions.

European bourses (Stoxx 600 -0.2%) began the session with a clear downward bias, and has traded sideways at subdued levels throughout the morning. Little price action was seen following the release of today's EZ Final PMIs/ECB Wage Tracker. European sectors began the session with a negative bias, and sentiment continues to remain downbeat. Healthcare tops the pile, lifted by post-earning strength in Novo Nordisk (+3.6%) and GSK (+5.2%). Autos and Parts has parked itself right at the bottom of the pile, with losses driven by downside in Renault after it was reported overnight that the Nissan/Honda merger could collapse; recent sources suggest the deal has been scrapped. The French automaker holds a 17% stake in Nissan. Nissan (7201 JT) board decides to scrap merger talks with Honda (7267 JT), according to Reuters sources.

Top European News

- The Times' Shadow BoE MPC voted 5-4 in favour of lowering the base rate by 25bps to 4.50% this week; the dissenters cited stubborn wage growth as justification for holding rates.

- ECB's de Guindos says he is not sure where ECB interest rates will end up; see inflation approaching the ECB target.

FX

- DXY is lower for a third consecutive session as markets continue to price in a more constructive trade environment after Trump's concessions to Mexico and Canada earlier in the week. From a US macro perspective, today sees the release of ADP in the run-up to Friday NFP print, whilst ISM services data is also due; a slew of Fed speakers are also on the agenda. DXY has crossed below its 50DMA at 107.77 with the next downside target coming via the 30th Jan low at 107.50.

- EUR/USD has gained a footing above the 1.04 mark, which is in stark contrast to the 1.0209 trough seen at the start of the week. This has mainly been as a result of the easing trade tensions between the US and Mexico/Canada. Final EZ PMI and the ECB's latest wage tracker data had little sway on EUR. ECB Chief Economist Lane is due to speak.

- GBP is once again on the front foot vs. the USD, whilst steady vs. the EUR. UK-specific drivers are on the light side in the run up to Thursday's BoE rate decision which is widely expected to see a 25bps rate cut via an 8-1 vote split. UK services PMI was revised lower but GBP was unfazed. Cable is up for a third session in a row with Monday's 1.2248 trough very much in the rear-view mirror, with the pair currently at 1.2520.

- Antipodeans are both near the top of the G10 leaderboard as optimism around trade continues to percolate following the easing of tensions between the US, Mexico and Canada earlier in the week. It remains to be seen whether this optimism is unfounded for the antipodes given that China’s retaliatory tariffs on the US come into effect on February 10th.

- PBoC set USD/CNY mid-point at 7.1693 vs exp. 7.2661 (prev. 7.1698).

Fixed Income

- A morning of gains for USTs, upside was initially modest in nature and tempered by hawkish developments out of Japan via the largest wage data and remarks from former official Hayakawa around potentially hiking twice more in 2025. Further upside in the complex continued in the European session, with some impetus potentially stemming from reports that China could investigate Apple. Specifically, USTs lifted to a 109-15 session high over the course of 20-minutes. Ahead, US ADP National Employment, ISM Services, Quarterly Refunding Announcement and a slew of Fed speakers.

- Bunds are firmer. For the bloc specifically, the region’s final PMIs have been subject to slightly more revision than is usually the case with French figures revised down amid political uncertainty; the EZ print saw Composite unrevised while Services saw a mild downward revision. The first formal release of the ECB’s wage data saw a very slight revision higher in the 2025 estimate to 3.256% from the initial 3.2% estimate; a slight pull back was seen in Bunds, but the upside has since continued alongside peers. Bunds at a current 133.64 peak.

- Gilts are following peers throughout the morning and hit a 93.47 peak just after the release of the UK’s own Final PMIs. Figures which were subject to modest negative revisions while the internal commentary points to an increasingly stagflationary environment.

Commodities

- Another soft morning for the crude complex despite the weak Dollar but after the US and Chinese presidents failed to conduct a call yesterday to discuss tariffs. On that front, US President Trump said he would speak to Chinese President Xi at the appropriate time and is in no rush, while he responded 'that's fine' when asked about China’s retaliatory tariffs. On the flip side, US President Trump signed a memorandum regarding maximum pressure on Iran. WTI Mar resides in a USD 72.17-72.97/bbl range and Brent Apr within 75.60-76.34/bbl confines.

- Firm trade seen in precious metals, partly amid the momentum gold has upheld as it prints fresh record highs. Spot gold has reached levels as high as USD 2,870/oz to the upside (vs USD 2,839.74/oz low) with clean air seen until prices reach round and half-round levels.

- Mixed trade in base metals with copper futures rangebound despite the return to the market of its largest buyer as participants also digested disappointing Caixin Services PMI data. 3M LME copper resides in a USD 9,151.00-9,209.00/t range.

- Iranian Oil Minister says unilateral sanctions on major oil producers will place pressure on OPEC, as US President Trump orders "maximum pressure" on Tehran. Adds, unilateral sanctions will destabilise the market.

- Private Inventory Data (bbls): Crude +5.0mln (exp. +2.0mln), Distillate -7.0mln (exp. -1.5mln), Gasoline +5.4mln (exp. +0.5mln), Cushing +0.1mln.

Geopolitics: Middle East

- US President Trump said he had fantastic talks with Israeli PM Netanyahu and many countries will soon be joining the Abraham Accords, while they discussed how to ensure Hamas is eliminated and Trump stated that Gaza should not go through the process of rebuilding and occupation by the same people, and instead, various domains should be built for Gazans to live in. Trump added the US will take over the Gaza Strip and own it with the site will be levelled and economic development to be created. Furthermore, Trump said they are working hard to get all hostages and more hostages will be released, if not, it will make 'us' somewhat more violent.

- Israeli PM Netanyahu said US President Trump is the greatest friend Israel has ever had in the White House and they must eliminate Hamas, recover hostages and ensure that Gaza does not pose a threat to Israel. Netanyahu also stated that Trump sees a different future for Gaza and it is a different idea worth paying attention to and could change history.

- Hamas official Sami Abu Zuhri said President Trump's remarks about the desire to control Gaza are ridiculous and absurd, while he added that any ideas of this kind are capable of igniting the region.

- Saudi Arabia stressed its rejection of attempts to displace Palestinians from their land and said it will not establish relations with Israel without the establishment of a Palestinian state.

- US Middle East envoy Witkoff said President Trump is telling the Middle East that Gaza will probably be uninhabitable for 10-15 years.

Geopolitics: Ukraine

- Ukrainian drone attack sparked a fire at an oil depot in Russia's Krasnodar region.

US Event Calendar

- 07:00: Jan. MBA Mortgage Applications 2.2%, prior -2.0%

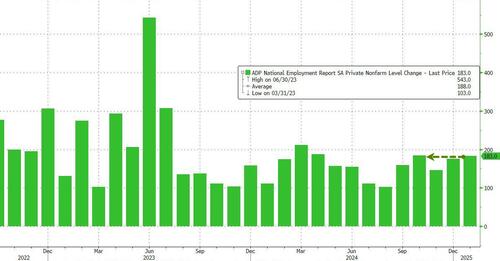

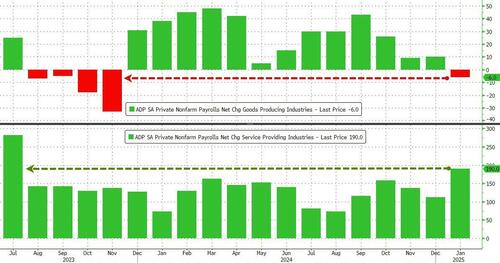

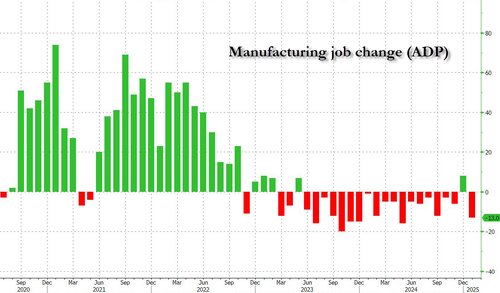

- 08:15: Jan. ADP Employment Change, est. 150,000, prior 122,000

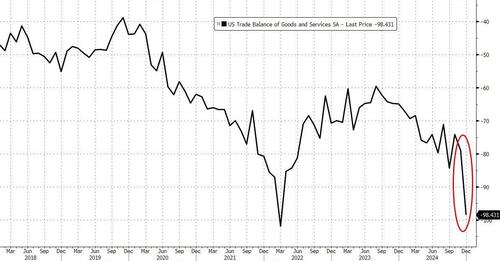

- 08:30: Dec. Trade Balance, est. -$96.8b, prior -$78.2b

- 09:45: Jan. S&P Global US Services PMI, est. 52.9, prior 52.8

- 10:00: Jan. ISM Services Index, est. 54.0, prior 54.1, revised 54.0

DB's Jim Reid concludes the overnight wrap

After a tricky few days for markets, the last 24 hours saw things begin to stabilise again, with most asset classes unwinding the tariff-driven moves around the weekend. For instance, the S&P 500 (+0.72%) posted a decent recovery, the VIX index (-1.41pts) fell back a bit, and the US Dollar also weakened after its recent surge. There wasn’t a single factor driving the moves, but investors have grown hopeful that the tariff delays for Mexico and Canada will mean that tariffs are ultimately avoided, whether that’s via further delays or some kind of deal. If that does transpire, then that would avoid a major trade shock that hits growth and raises US inflation, hence the more positive market reaction over the last 24 hours. Nevertheless, there’s little doubt that markets remain pretty nervous about the whole situation, withtariff risk still being priced in to several key assets, and gold prices (+0.98%) hit an all-time high of $2,843/oz.

Some of that optimism followed reports that a call between President Trump and President Xi was being scheduled, leading to speculation about whether something might also be worked out with the 10% China tariffs now in force. However, that was then downplayed, with Trump himself saying “We’ll speak to him at the appropriate time. I’m in no rush”. We’re starting to see some real economy impacts from the new tariffs as well, as the US Postal Service suspended inbound international packages from China.

Reflecting the growing optimism on tariffs, some of the best performers yesterday were the most trade-sensitive assets. For instance, the Canadian Dollar (+0.74%) strengthened further against the US Dollar, continuing to bounce back from its 9-year low on Friday. Another outperformer was the NASDAQ Golden Dragon China Index (+2.65%), which is made up of companies that are publicly traded in the US, but where a majority of their business happens in China, though this did give up some of its gains after being up +4.3% intraday. And over in Europe, the STOXX Automobiles & Parts Index (+2.09%) had its best day in four weeks, as investors grew a bit more confident that tariffs might be avoided.

Aside from the latest trade developments, markets got a further boost from the latest JOLTS report of job openings from the US, which showed the labour market remained on an even keel into December. Admittedly, job openings fell by more than expected, down to a 3-month low of 7.6m (vs. 8m expected). But it still meant the ratio of vacancies per unemployed workers was at 1.10, which is broadly in line with its levels over the previous 6 months. Moreover, the quits rate (2.0%), the hires rate (3.4%) and the layoffs and discharges rate (1.1%) were all unchanged. So from a market point of view, it was in a goldilocks zone where it wasn’t showing inflationary pressures from a tight labour market, but it didn’t show a serious deterioration either.

All-in-all, that helped the S&P 500 (+0.72%) to recover after the last couple of sessions, aided by a strong performance for the Magnificent 7 (+1.70%). Palantir (+23.99%) saw the best performance in the S&P 500, which came as their revenue forecast surpassed estimates. However, the tech mood then soured after the close as Alphabet’s quarterly results missed sales estimates amid slowing growth in its cloud business, with the company also announcing a higher than expected 2025 CAPEX plan. The stock fell by more than -7% in after-hours trading. Next up on the Mag 7 earnings are Amazon, who report after tomorrow’s close. As seen on slide 6 of Jim’s “Deeply seeking comparisons to 2000” chat pack last week (link here), investors are expecting 9-22% per annum growth in earnings for the Mag-7 for the next 5 years, so the expectations bar is high, and any disappointment in earnings are likely to be met with a sharp sell-off.

Meanwhile in rates, US Treasuries also unwound the previous day’s moves, with yields moving lower across the curve. That was supported by comments from Fed Vice Chair Jefferson, who reiterated the view that he saw “a gradual reduction in the level of monetary policy restraint” as “the most likely outcome”, even as he said that “I do not think we need to be in a hurry to change our stance.” So along with the tariff delays, that supported investors’ belief that the Fed would still cut rates this year, and the amount of cuts priced in by the December meeting moved up +2.4bps on the day to 44.5bps. In turn, that helped Treasury yields to move lower, with the 2yr yield (-3.5bps) down to 4.21%, whilst the 10yr yield (-4.4bps) fell to 4.51%.

Over in Europe, markets also put in a decent performance that unwound much of the previous day’s moves. For sovereign bonds, that meant yields rise across most of the continent, as the prospect of fewer tariffs saw investors dial back the likelihood of rapid ECB rate cuts. So that helped yields on 10yr bunds (+1.4bps) to move back up a bit. Moreover, there was a fresh tightening in sovereign bond spreads, with the Franco-German 10yr spread falling to 71.4bps, its tightest since mid-September. European equities also advanced, with gains for the STOXX 600 (+0.22%) and the DAX (+0.36%), and there were particularly strong gains in southern Europe for Italy’s FTSE MIB (+1.38%) and Spain’s IBEX 35 (+1.37%). Otherwise, there wasn’t too much ECB commentary, but France’s Villeroy confirmed existing market expectations that “there will probably be more” rate cuts.

Overnight in Asia, data has shown Japanese wages growing by their fastest pace since 1997 in nominal terms, cementing the view that the Bank of Japan are set to keep hiking rates. That’s led yields to rise across the curve, with the 10yr JGB yield (+1.2bps) up to 1.28%, which is its highest level since 2011, whilst the Japanese Yen has strengthened by +0.61% against the US Dollar overnight. In terms of the data itself, it showed that nominal earnings were up by +4.8% year-on-year (vs. +3.7% expected), and real earnings were up +0.6% year-on-year (vs. -0.1% expected). This morning the Nikkei (+0.07%) is broadly flat. Elsewhere in Asia, the CSI 300 (-0.27%) and the Shanghai Comp (-0.36%) both fell back as they reopened after the holiday, although South Korea’s KOSPI (+1.04%) is on track for a second consecutive advance. Looking forward, US equity futures are pointing lower after Alphabet’s earnings, with those on the S&P 500 down -0.42%.

To the day ahead now, and data releases from the US include the ISM services index for January, the ADP’s report of private payrolls for January, and the trade balance for December. Otherwise, there’s the final services and composite PMIs for January from around the world. From central banks, we’ll hear from Fed Vice Chair Jefferson, along with the Fed’s Barkin, Goolsbee and Bowman, and the ECB’s Lane.

Tyler Durden

Wed, 02/05/2025 - 08:17

Cars travel along Interstate 80 in Berkeley, Calif., on Jan. 16, 2024. Justin Sullivan/Getty Images

Cars travel along Interstate 80 in Berkeley, Calif., on Jan. 16, 2024. Justin Sullivan/Getty Images

Illustrative: USAF

Illustrative: USAF

Via AFP

Via AFP

Recent comments